EDU Holdings ($EDU ASX): A Hidden Aussie Growth Story Trading at 7x Forward Earnings

95% revenue growth, aggressive buybacks, insider buying, so why is it this cheap?

EDU Holdings is an Australian higher education provider that most people haven’t heard of.

Trading at $100M market cap ($0.7 per share), 1.2x P/S, 11.5x PE (soon to be ~7x), 95% revenue growth YoY, and a conservative DCF puts it >$3.

Full Year earnings are on the 26th of February.

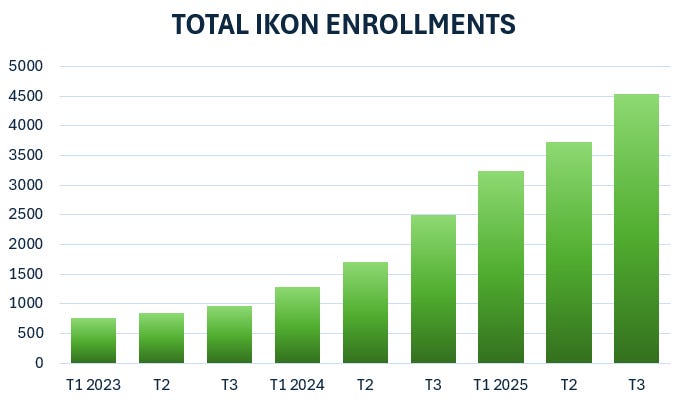

Student enrollments continue to balloon, with latest figures for Trimester 3 rising 82% YoY.

Management continuously shows they are extremely competent, and uses cash in great ways such as their latest large buybacks, boosting EPS.

CEO/founder led, and CEO increased stake by 4M shares in 2025, excluding RSU’s/Options.

All figures are in AUD$; published 17 Feb 2026 @ Share price of $0.7

Business Overview

EDU operates two distinct businesses:

Australia Learning Group (ALG): A vocational pathways and polytechnic division in structural decline. This business is shrinking and now represents less than 23% of total revenue, down from 64% just three years ago.

Ikon Institute: Bachelor’s, diploma, and recently master’s programs across arts, education, therapy, social work, and counselling.

This is where the growth is happening. Ikon now accounts for over 77% of revenue and is quietly becoming one of the more interesting education stories on the ASX.

The thesis here isn’t about ALG stabilizing, it’s about Ikon growing fast enough that ALG becomes irrelevant.

The Structural Shift: Online Delivery

Here’s what makes Ikon interesting: a rapid and permanent shift to online delivery.

Around 76% of students are now studying online, up dramatically from three years ago.

This isn’t just a cosmetic change, it’s a structural margin expansion story. Physical campuses shrink, fixed costs fall, but students pay the same fees and receive the same accreditation. The business is becoming leaner and more scalable without sacrificing revenue per student.

EBITDA margins have already expanded to approximately 30%, and there’s room to push toward >36% longer term as the online mix continues to increase and fixed costs get further leverage.

Enrollment Growth: The Core Metric

Enrollment figures are accelerating, not decelerating:

Latest Trimester 3 2025 enrollments in Australia: 4,537 students, up 82% YoY

International enrollments surged 66% in H1 FY25 despite broader visa policy tightening

Average course duration has grown from 26 months to 34 months

That last point is critical. Longer enrollments mean more embedded revenue per student and significantly better forward visibility. With a roughly three year average course length, you can essentially see the revenue before it arrives.

Contract liabilities (deferred tuition revenue) exploded from $3.5M in December 2024 to $17.7M by June 2025, an increase of $14.2M. Students are paying upfront, the pipeline is expanding, cash conversion is strong, and visibility is improving.

Management has explicitly stated they expect Term 1 2026 to be “very strong.”

Enrollments are showing no signs of slowing.

Buying Back Stock Aggressively

The capital allocation story deserves attention:

$22.8M in cash on the balance sheet (AFTER BUYBACKS!), roughly 25% of the entire market cap

$18M share buyback announced for 2026.

Float has been reduced to ~125M shares (from ~160M), directly boosting EPS for 2026.

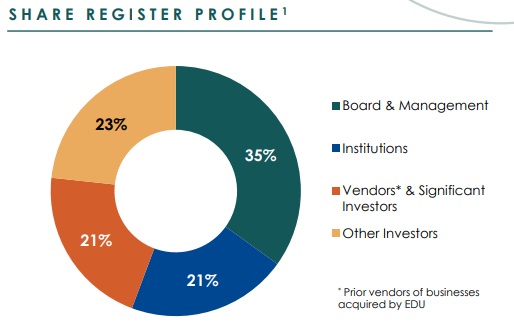

Institutional ownership rose further to ~30-35% in the second half of 2025, with Wilson Asset Management taking a large stake.

Insiders owned 35% of the company 6 months ago, but likely is a bit lower now, due to the Chair selling in H2.

CEO and founder Adam Davis increased his personal stake by 4M shares in 2025, plus RSUs.

Director Peter Mobbs has been increasing his indirect position through a fund he manages.

~1/4 of the float owned by insiders is now a reasonable estimate.

The board has explicitly stated that the “current share price does not reflect intrinsic value”. When management puts their own money where their mouth is at these levels, it’s worth paying attention.

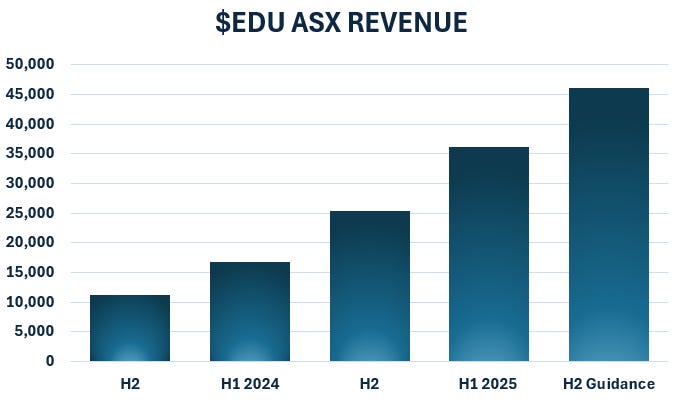

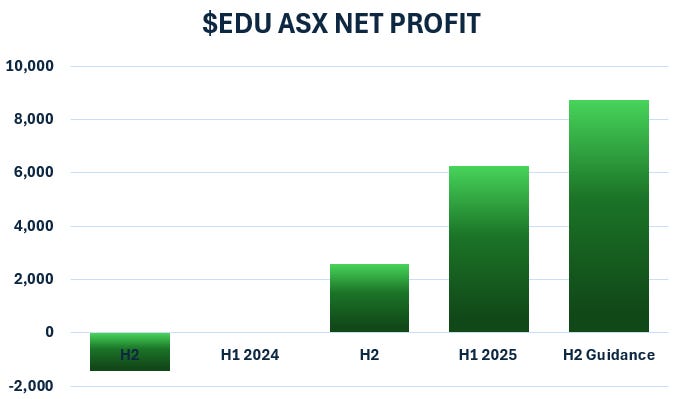

The Financials: Rapid Growth, Expanding Margins

Revenue: FY25 revenue is expected to come in at approximately $82M, at the top end of guidance, representing roughly 95% growth YoY.

Profitability: Net profit has continued to rise into H2 2025. The business now generates approximately 30% EBITDA margins, with a path to >36% as online delivery scales further.

Valuation: At a current share price of approximately A$0.70 and forward (soon to be current, 26th Feb) EPS of $0.10, the ‘forward’ PE ratio sits around 7x.

The price to sales ratio is just 1.2x, excellent for a business nearly doubling revenue.

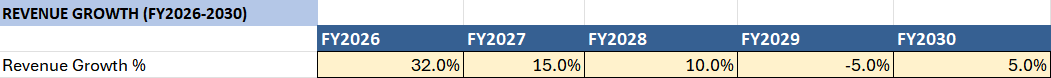

DCF: A conservative DCF places it around $3 per share. Using these growth estimates, 2.5% terminal growth, and a WACC of 10%.

Dividend: Currently paying around 1.4% dividend yield.

For comparison, public peers in the Australian education space are not showing similar growth trajectories, and are mostly struggling to turnover a profit, or increase revenue. These include NXD, AKG, among others.

NXD revenue fell 16% in 2025, and is still operating at a large loss.

AKG on the other hand has experienced no revenue growth in 3 years, and is unprofitable.

The Elephant in the Room: International Student Risk

Approximately 85% of Ikon’s students are international. This is a massive concentration risk - immigration policy can shift unpredictably, compliance costs can escalate, and enrollment limits could cap growth.

The mitigating factors: Most international students are already onshore. Management states that new international students continue to be recruited primarily onshore, many through the ALG pipeline or with existing visas.

This reduces offshore visa bottleneck exposure. Despite visa policy tightening, international enrollments still surged 66% in H1 FY25, and the company reaffirmed guidance after January 2026 visa changes.

High barriers to entry create a moat for established providers, and reputation can act as a moat.

But let’s be clear: if Australian immigration policy shifts dramatically against international students or onshore visa processing tightens significantly, this thesis breaks. The 85% concentration is real and the primary reason this stock trades at these multiples.

Management knows this uncertainty, and is engaging to make a greater % of students domestic.

Why the Opportunity Exists

The market prices EDU as if international student risk will materialize imminently, growth is unsustainable, and margins won’t expand. The data shows students are already onshore with multi-year enrollments, enrollments are accelerating, and the online shift is structural.

The disconnect likely stems from: small-cap illiquidity, sector-wide regulatory concerns, and little analyst coverage.

The fact that already rose ~1000% in 2025 doesn’t help either, a pullback is expected.

Yet the company generates cash, buys back stock aggressively, grows enrollments 82% YoY, and insiders are buying.

With FY25 earnings due February 26 and management guiding to the top end of expectations, the next few weeks could provide a catalyst for re-rating, or confirmation of the market's skepticism. Either way, the setup is compelling, and I have entered a position in mid $0.60’s.

The 76% online migration really is the hidden story here. I worked with an ed-tech accelerator back in 2021 and saw similar dynamics - once you cross 70% online, unit economics just flip completley. The deferred revenue jump ($3.5M to $17.7M) tells you students are locked in for multi-year programs. If Adam Davis is buying 4M shares at these levels while sitting on $22M cash, that says alot about pipeline confidence.

Hi, also a holder here. I wanna ask, did you take any look at Aussie childcare companies? Like Nido, Embark or G8. Stocks are absolute falling knives, but companies are fundamentaly doing pretty well. I´m talking to people now to get an opinion on which one could be best for investment and if there are any other players.