Omada Health ($OMDA): The Mispriced Multi-Condition Growth Play

Founder led, cash rich, nearing profitability, and uniquely positioned to ride the GLP-1 and chronic disease boom

Omada Health, OMDA, is a “between visits” healthcare provider, addressing chronic conditions including GLP-1 supported weight loss, obesity, diabetes, hypertension, and musculoskeletal (MSK).

1 in 8 (and increasing) Americans are currently using GLP-1 for weight loss or diabetes - a major tailwind for Omada.

OMDA went public in mid-2025 and is currently trading at $16, down from recent highs of $28.

With a market cap hovering around $900M, it’s a founder-led small cap with strong potential to return above $30 in 2026.

Membership and revenue have shown consistent upward trends, with profitability nearing an inflection point toward positive net income.

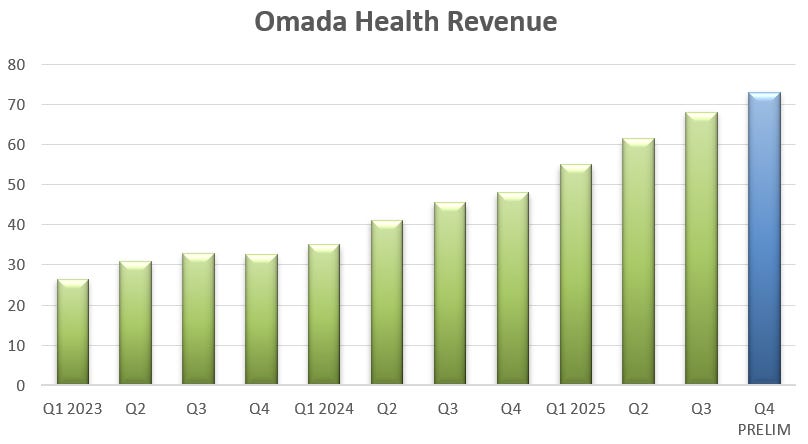

Q4 revenue ($72-74M prelim) has already come in higher than analyst estimates of $69.8M

Analysts are pricing in little growth, with Q1 revenue estimated at only $71M, which they have already surpassed.

COMPANY & INDUSTRY OVERVIEW

What do they do?

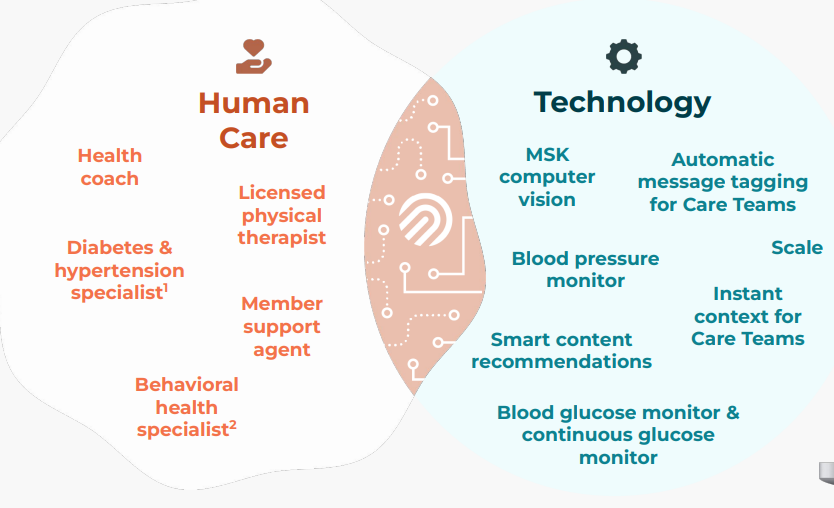

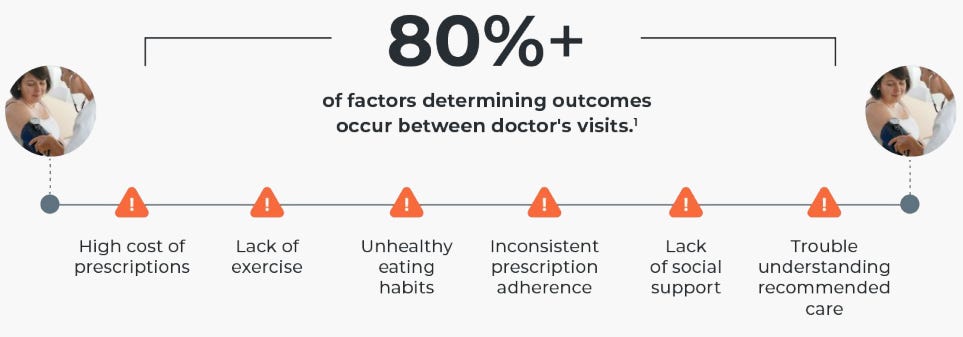

Omada Health delivers virtual care between doctor visits for chronic conditions.

Their platform integrates human care teams, real-world connected devices (e.g., scales, blood pressure monitors), and AI-powered tools like Meal Map and OmadaSpark (AI-driven nutrition education feature).

Rather than reacting to issues after they arise, Omada is proactive - preventing progression and supporting better outcomes through timely coaching and insights between visits.

They boast over 30 peer-reviewed publications demonstrating the strong clinical effectiveness of the Omada Health app for ALL conditions.

This evidence base serves as a meaningful moat, validating both outcomes and cost savings.

It’s estimated that 80% of health outcomes are influenced by factors occurring between doctor visits, which is exactly where Omada focuses.

In 2024, they tracked massive data: 50k points every 60 seconds, 149M meals logged, and 78M glucose readings - feeding their AI machine and recursively giving better outputs for members.

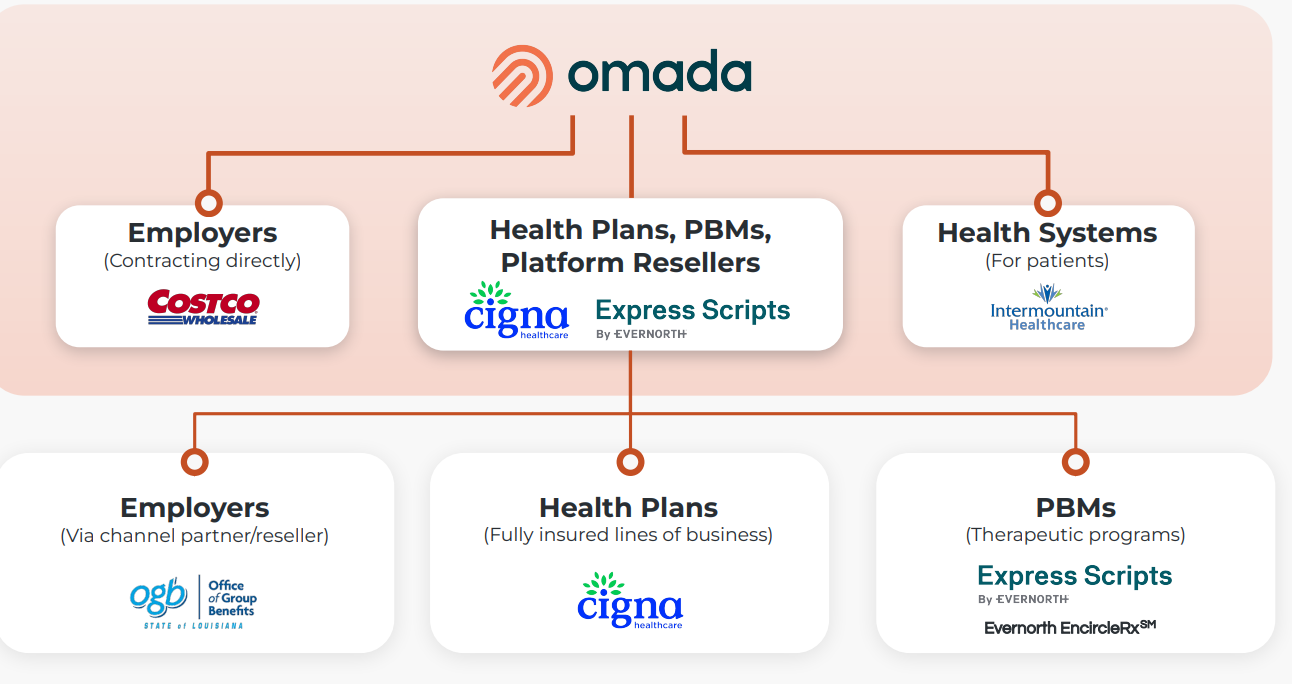

The company partners with employers, health plans (major ties to Cigna, Costco), and providers.

Members opt in if eligible through these partners, rather than direct-to-consumer. Eligible patients receive outreach (often via email) and hardware kits tailored to their condition.

The Industry

Public competitors include Teladoc (TDOC) and Hinge Health (HNGE), which also went public recently.

Others like Virta Health, Noom, Vida, Hello Heart remain private.

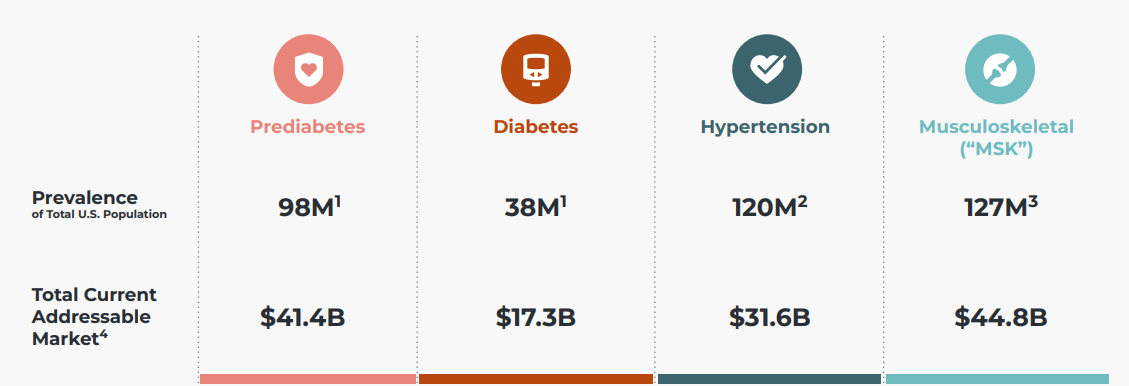

Omada’s TAM covers 20M+ individuals with covered benefits for its programs.

Long term global expansion looks very feasible via partnerships with Cigna (a global player) and other multi-nationals.

In the USA, 136 million have prediabetes/diabetes, 120 million have hypertension, and 127 million have MSK issues.

Many conditions overlap, boosting retention as members stay for multiple conditions (even after one may be cured) and reducing hardware sends per user (favoring scalable SaaS-like revenue).

74% of those with diabetes also have hypertension, according to Omada.

58% of people with diabetes also have MSK.

30% with prediabetes also have hypertension.

Multi-condition customers are growing at an average of 31% YoY.

Further, using Omada Health for weight health, diabetes, hypertension, & MSK saves between $3000-4000 in healthcare over 3 years, according to Omada, benefitting the providers like Cigna.

Membership Engagement & App

Obesity, diabetes, and related issues continue rising in the U.S. and globally, amplified by strong GLP-1 adoption.

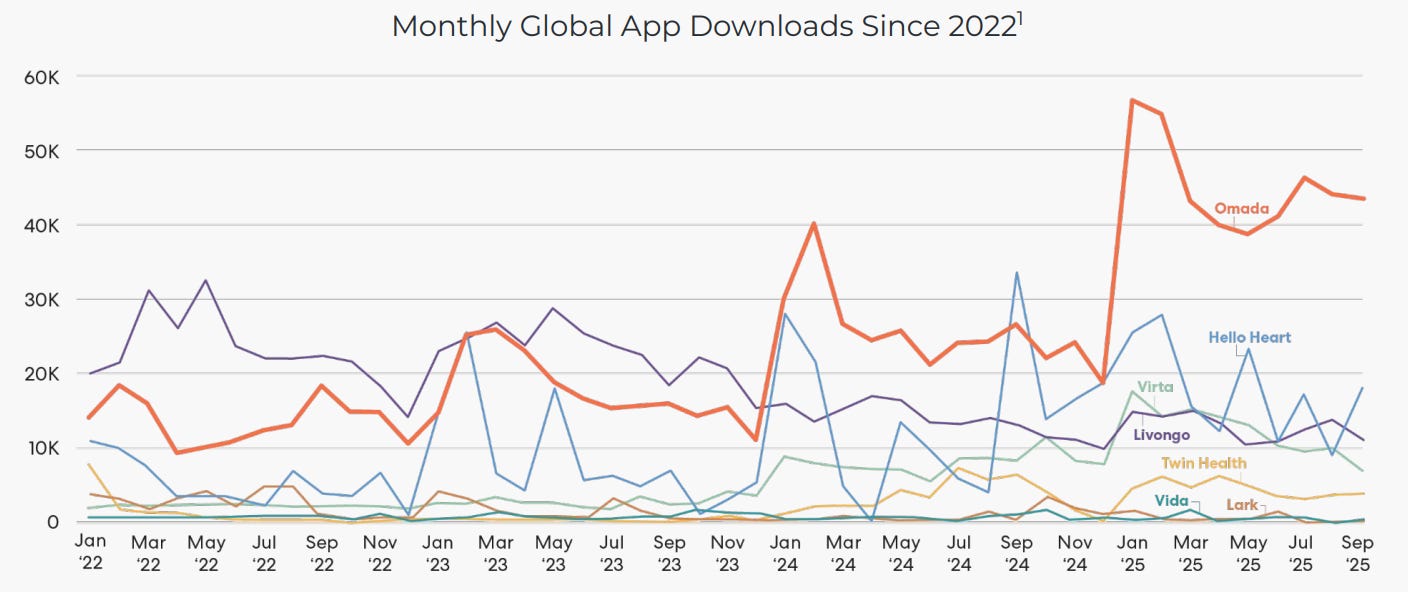

Omada’s app has been among the most downloaded in its category versus peers, jumping ahead in 2025.

After 1 year, 55% of members are still engaging on Omada’s app, and after 2 years, 50% are still there.

High stickiness drives recurring revenue and operating leverage (app maintenance is low-cost vs. new hardware onboarding).

App Store rating: 4.7 stars, reflecting strong user satisfaction.

ANALYSTS & PRICE

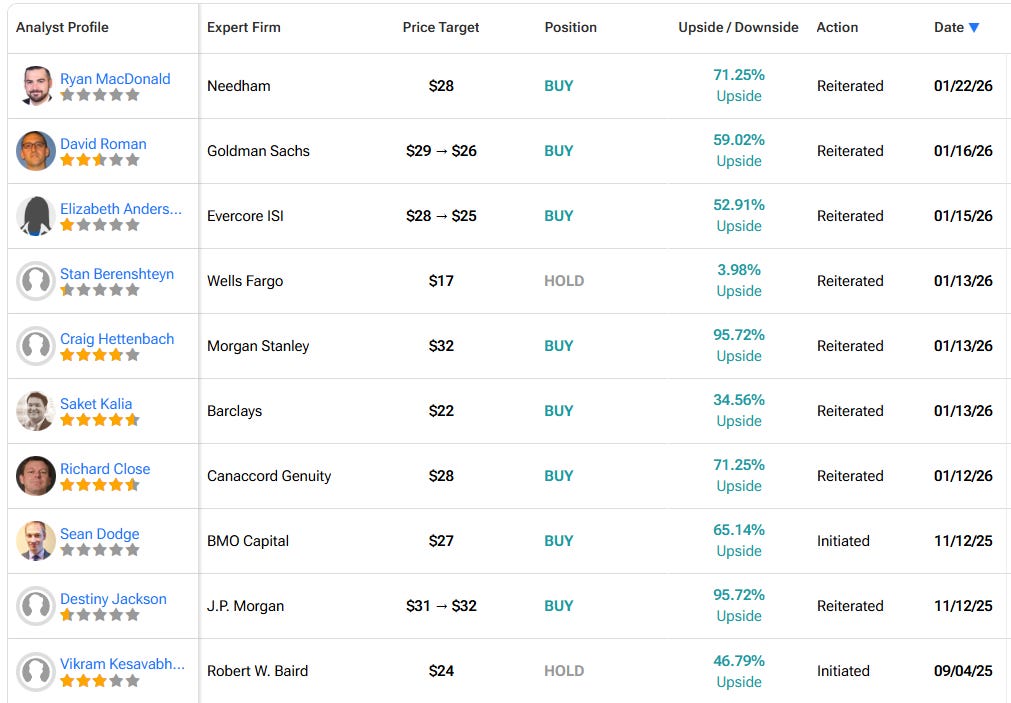

Analyst estimates, known to be conservative to cover their asses, are almost all buys, putting it at an average price of $26.3.

I believe the price will rise to at least $30 over 2026.

Current price has stabilized at $16, after double bottoming at $14.40.

MEMBERSHIPS KEEP RISING

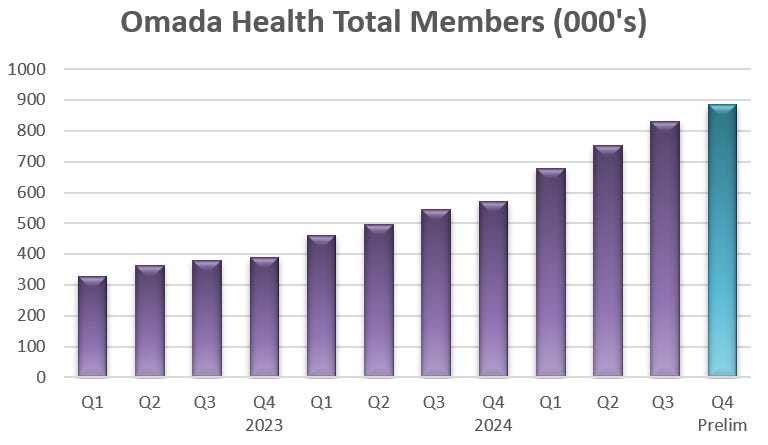

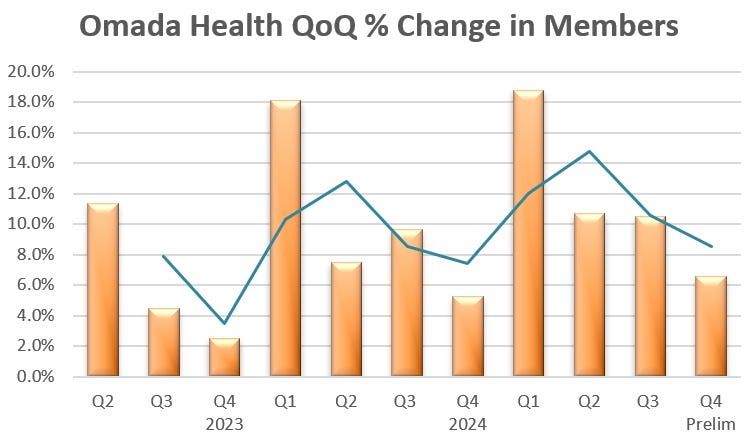

The preliminary Q4 results show Omada finished 2025 with 886k members.

Members grew 46% in 2024 and 55% in 2025 - their strongest year yet.

The trend is clearly continuing forward in a prosperous industry, showing no signs of slowing.

Even in seasonally weak Q4, membership grew 6.6% QoQ.

Seasonality suggests a robust Q1 2026 ramp-up - likely close to a ~20% rise in members.

REVENUE GROWTH

Omada’s revenue for Q4 2025 was given in the range of $72-74M, a continuation of the strong trend.

Q4 analyst estimate on Yahoo Finance is $69.8M, and $70.95M in Q1, meaning analysts are not pricing in any growth, and Omada has already surpassed estimates.

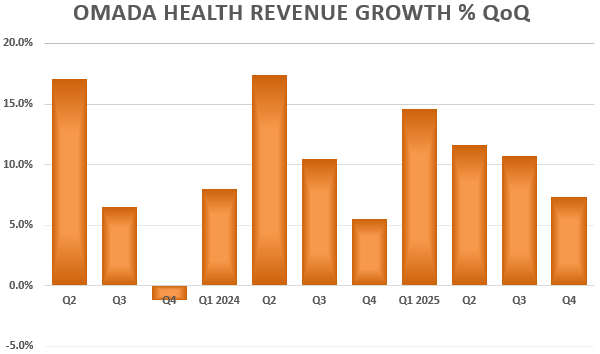

Revenue has been increasing at an average of 10% each quarter, with 2025 showing a 52% annual growth.

They are showing more consistent quarterly patterns despite seasonality (Q1 strongest, Q4 weakest), which is good for the stock’s price stability.

Revenue Streams

92% from scalable online services (app-based coaching/AI/tracking); 8% from hardware.

Services drive strong, ever-increasing, operating leverage as they scale efficiently.

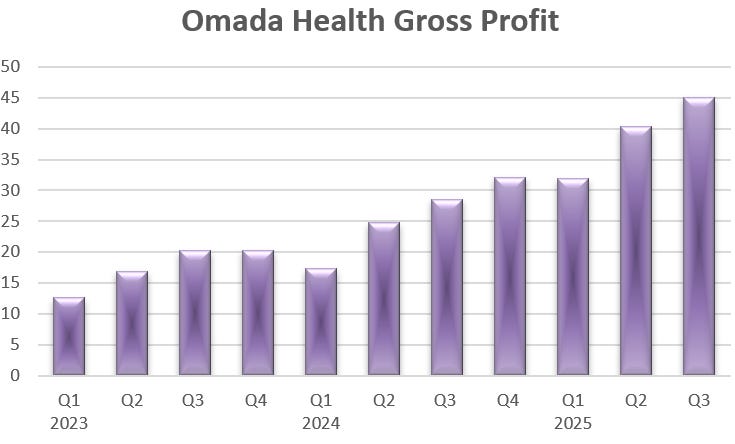

Gross Profit

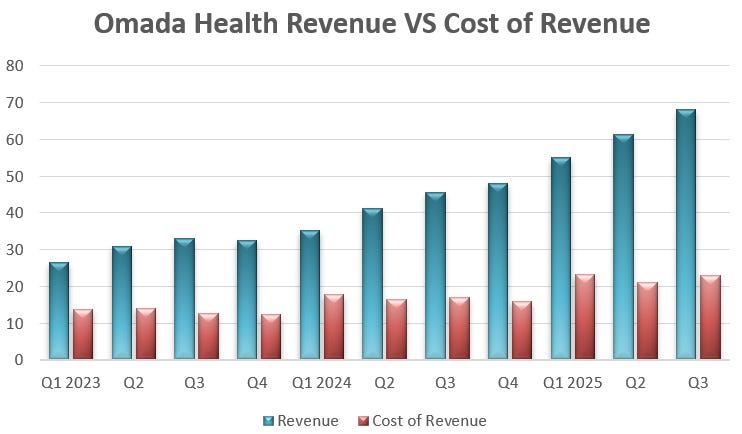

Their cost of revenue is increasing at an average of 6.9% quarterly, while revenue increases at 10.2% quarterly.

As revenue is scaling faster than the cost of revenue, gross profit has been increasing rapidly with an average of 15% quarterly, and a yearly increase of 60%.

As they scale further, this operating leverage effect takes more prevalence, leading to greater EPS and profits for us shareholders.

Operating Expenses

Total operating expenses are increasing at 3.9% a quarter - a modest increase considering their impressive revenue generation.

Overall costs + expenses are increasing much slower than revenue, which leads to…

PROFITABILITY

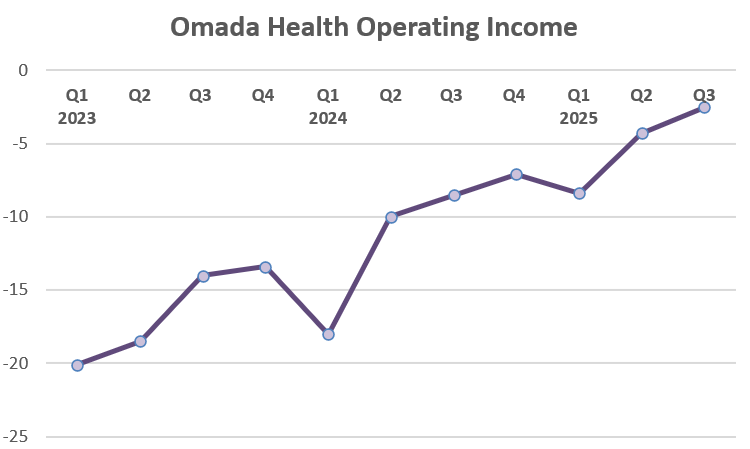

Operating Income

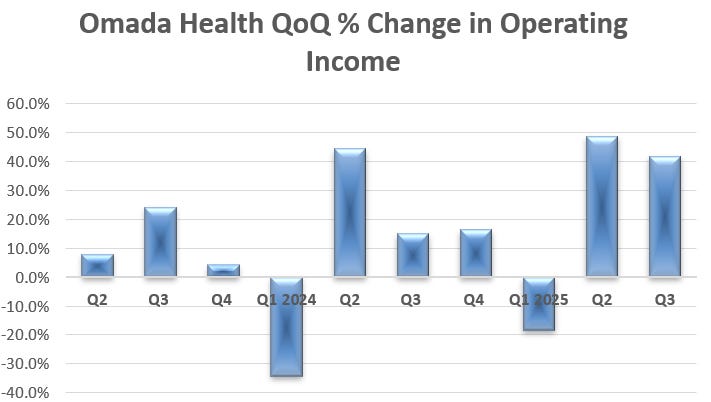

Omada is approaching an inflection point in operating income, likely in Q2 2026, with it rising 15% quarterly.

In Q3, their operating income was -$2.5M, while one year ago it was -$8.5M.

Q1 sees a rise in costs due to onboarding many new customers (high initial hardware costs).

As revenue has been increasing far faster than both cost of revenue and operating expenses, their operating income is on the rise.

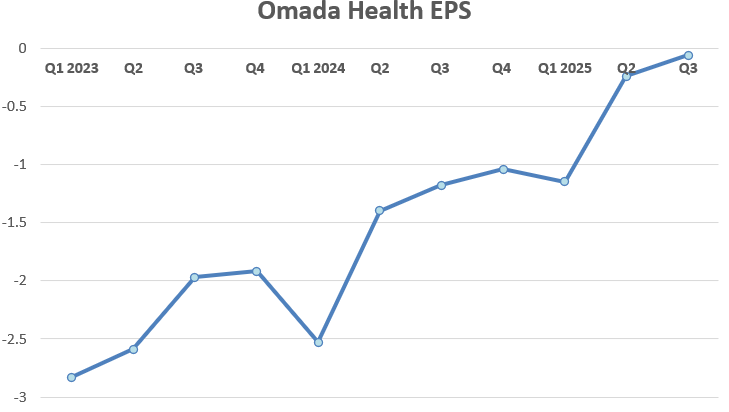

Net Income & EPS

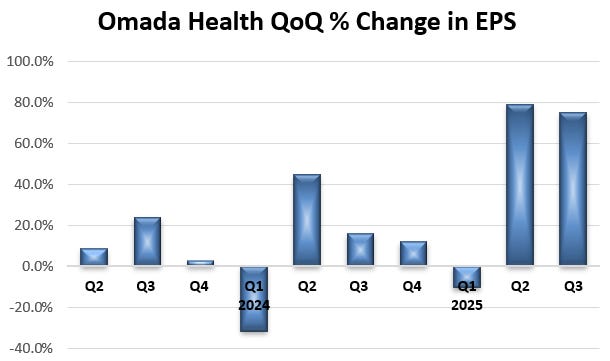

Omada’s EPS was $-0.06 in Q3, compared to -$1.18 in Q3 2024.

While Omada has not yet seen a full positive EPS year, it appears they are approaching an inflection point.

I believe Q4 could be their first positive EPS quarter, or at least very close, based on their history as Q4 usually sees an increase in EPS, before falling in Q1.

EPS increased from Q1 to Q2 2025 79%, and from Q2 to Q3 rose 75%.

BALANCE SHEET IS SUPER STRONG

Omada’s balance sheet in Q3 had them sitting on $198M in cash.

With only a $900M market cap, this is a very strong position to be in.

Their current ratio is 3.63, meaning they have extremely good liquidity.

They are in a very strong position to expand offerings, acquire market share, and possibly expand overseas.

The market is essentially valuing the operating business at only $700 million (900M market cap − 200M cash).

Their debt to equity ratio is 0.32, which is healthy, showing low leverage.

However, this also means the stock price may not be able to swing as high, due to the company using low leverage (unlike TIGR), but are very nicely setup for stable, strong future long term growth.

2 MAIN DOWNSIDES

Customer concentration risk:

Omada has heavy reliance on Cigna and affiliates for revenue, meaning Cigna and others hold some leverage over Omada in terms of contract pricing.

Top 5 health plan customers accounted for 68% of revenue in Q1 2024–2025.

A contract change, non-renewal, reduced referrals, or shift to competitors could materially hurt revenue.

Mitigations: The Cigna relationship is strategic and deep (preferred digital health provider in their formulary, including GLP-1 support):

Cigna holds ~6% equity in Omada Health for alignment, so want Omada Health to appreciate in price, and thus make more profit.

Management is also diversifying via direct employer deals (e.g., Costco), but progress is gradual.

Competition risk:

The virtual care space is getting more crowded, especially in obesity, GLP-1 support, and chronic condition management.

Omada operates in a differentiated B2B2C model - employers and health plans pay for access (members don’t pay directly), creating stickier enterprise relationships and higher barriers for D2C competitors.

Hinge Health (HNGE) is primarily MSK-focused:

Q3 2025 revenue: $154.2M (~53% YoY growth), Market cap: $3.2B

‘Revenue/market cap’ for HNGE = 48, while Omada = 72

HNGE has ~double the revenue, but ~three times the market cap.

Operating Expenses are increasing much faster, at ~60% YoY, compared to only 15% YoY for Omada.

Growth is solid, but their scope is narrower than Omada’s multi-condition platform

Teladoc (TDOC) is a broad telehealth company with Livongo (diabetes/hypertension), BetterHelp (mental health), and some weight programs:

Q3 2025 revenue: $626M (falling YoY), market cap: $1B

Still reporting large net losses (-$49.5M in Q3), with no clear path to profitability.

Scaled but growth stalled; less specialized in integrated multi-condition + GLP-1 care

Key differentiator: Omada is the only major player offering a full integrated suite, with Prediabetes/prevention, GLP-1, Obesity/weight health, hypertension, diabetes, and MSK.

Many members have multiple chronic conditions, leading to a preference for Omada over single-condition or narrower rivals

The TAM is very large, and many players can co-exist and prosper.

MANAGEMENT & INSIDER OWNERSHIP

Founder/CEO Sean Duffy (since 2011) owns ~1.5% of shares outstanding, aligning incentives with shareholders to drive long-term value.

This excludes his substantial unexercised stock options (long-dated from pre-IPO grants & ongoing options awards).

2024 comp: $412k salary, $323k bonus, $454k in stock options.

There is a similar equity/options-heavy structure for CFO, President, and key execs.

Glassdoor: 4.2 stars overall, 94% CEO approval - positive culture and employee treatment.

Results for Q4 are due on March 5th, and I will put out updates both here and on X

Feel free to check out my other deep dives by clicking on the name at the top!

Note: I obviously hold a position in OMDA, and am still building at prices under ~$16.